Introduction

The ability to exercise patience and foresight is often overlooked when making investments. At Lokal Capital, we recognize the importance of playing the long game in angel investing. As a community-based venture capital model, we empower local Kenyans and Africans to come together, pool resources, and invest in promising startups that drive positive change. Let’s talk about the concept of patient capital and explore strategies to maximize returns while supporting local innovation.

What is Patient Capital?

Patient capital is a strategic approach to investing that prioritizes long-term value creation over short-term gains. Unlike traditional venture capital, which often focuses on rapid growth and quick exits, patient capital recognizes the importance of sustainable growth and impact. By taking a patient approach to investing, angel investors can support startups through the ups and downs of their journey, allowing them the time and resources they need to succeed.

The Lokal Capital Model

Lokal Capital has developed a unique model that harnesses the power of community-driven investing. Our platform brings together local investors (and potential investors as well) from Kenya and across Africa to collectively raise funds and invest in promising startups. By leveraging the collective wisdom and resources of our community, we are able to provide startups with the patient capital they need to thrive. Our current portfolio includes ElevateHR Africa - a cloud based HR Platform for the African market, Shukran - a digital tipping platform for service workers, and Kinetic Education - an edtech platform that empowers young students with entrepreneurial and problem-solving skills of the 21st Century.

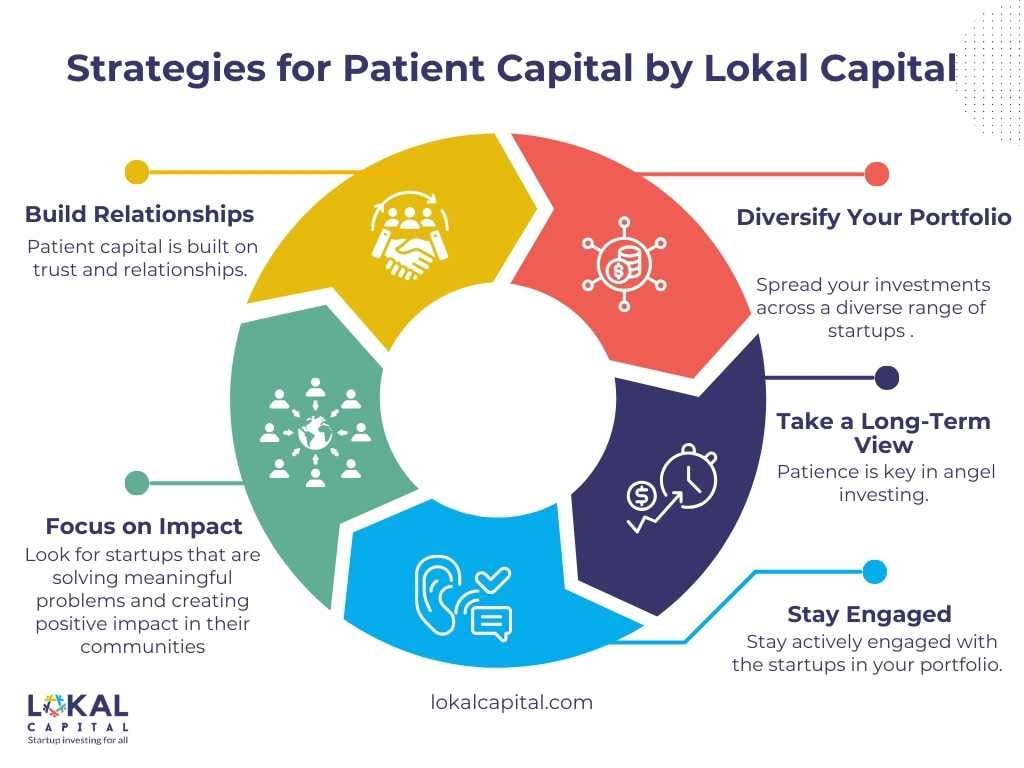

Strategies for Patient Capital in Angel Investing

1. Build Relationships: Patient capital is built on trust and relationships. Take the time to get to know the founders and teams behind the startups you invest in. By developing strong relationships, you can better understand their vision, values, and long-term goals.

2. Focus on Impact: Look for startups that are solving meaningful problems and creating positive impact in their communities. Patient capital is about more than just financial returns – it's about supporting ventures that make a difference.

3. Diversify Your Portfolio: Spread your investments across a diverse range of startups to minimize risk and maximize potential returns. By diversifying your portfolio, you can weather market fluctuations and increase your chances of success.

4. Take a Long-Term View: Patience is key in angel investing. Understand that building successful startups takes time, and be prepared to ride out the ups and downs of the journey. By taking a long-term view, you can position yourself for sustainable growth and success.

5. Stay Engaged: Stay actively engaged with the startups in your portfolio. Offer support, guidance, and resources where needed, and be prepared to adapt your strategy as the company evolves. By staying engaged, you can help position your investments for long-term success. a Long-Term View: Patience is key in angel investing. Understand that building successful startups takes time, and be prepared to ride out the ups and downs of the journey. By taking a long-term view, you can position yourself for sustainable growth and success.

Angel Investing for Positive Change

As angel investors, we have a unique opportunity to drive positive change and support local innovation through patient capital. By embracing the principles of patience, purpose, and community, we can build a brighter future for startups, investors, and communities alike. Lokal Capital is committed to empowering local investors and entrepreneurs to succeed together. Join us in investing for the future and building a more prosperous and sustainable world.